Did Black Friday, once synonymous with jaw-dropping discounts and doorbuster deals, taken a turn for the worse? We set out to investigate whether shoppers are genuinely dissatisfied with the annual sales frenzy or if it’s just another social media buzz.

To uncover insights about the mobile customer experience of Black Friday offers, we analyzed a sample of clothing, apparel, and pure e-commerce players. The brands included in our study were H&M, Pull&Bear, Nike, Adidas, Zalando, SHEIN, Wayfair, Zara, Fashion Nova, and Mango.

Starters: Customer Sentiment during Black Friday Week

We analyzed Google Play Store and App Store reviews for these 10 brands during Black Friday week (November 25th to December 1st).

Here are some preliminary findings:

- Out of 1,173 reviews, only 58 (approximately 5%) mentioned Black Friday promotions.

- The average star rating given by customers who mentioned Black Friday in their reviews was 2.02 out of 5. In comparison, the overall average star rating for all reviews during this period was 3.5.

- 2% of the reviews were five-star reviews, while a significant 62.1% were one-star reviews.

- The overall share of positive sentiment across all experiences was 51%.

- Joy was the most prominent emotion in the reviews at 45%, followed by anger at 21% and trust at 19%.

The Prominent Negative Themes

Diving into the reviews, several recurring themes emerged, painting a troubling picture of consumer dissatisfaction:

- Misleading Promotions – Pull&Bear

Customers felt lured in by flashy advertising from Pull&Bear, only to discover that the actual discounts didn’t live up to the hype. - Discounts on Low-Quality or Unpopular Products – Nike, Zalando, Mango

Many shoppers complained that the best deals were tied to unpopular or low-quality items on platforms like Nike, Zalando, and Mango, leaving them unimpressed with the overall value. - Exclusions on Discounts – Nike, Adidas, Pull&Bear, Mango

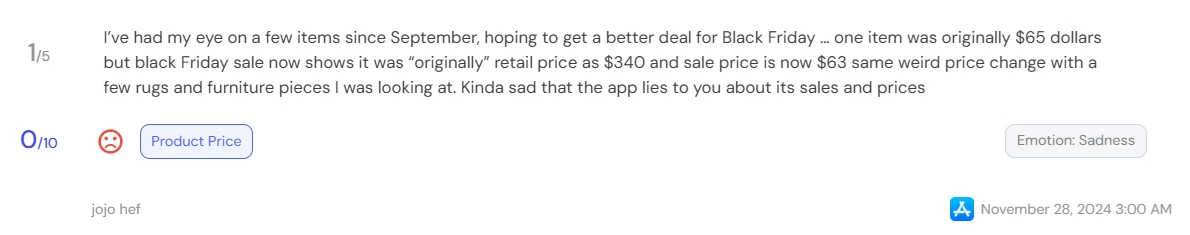

Reviews frequently mentioned exclusions, with popular products from companies like Nike, Adidas, Pull&Bear, and Mango often being left out of promotions altogether. - Inflated Prices Before Sales – SHEIN, ASOS, Wayfair

Several customers noted price hikes in the weeks leading up to Black Friday on platforms such as SHEIN, ASOS, and Wayfair, making the discounts feel far less substantial. - Suspicions of Website/App Manipulation or Crashes – Fashion Nova, ASOS, Massimo Dutti, Pull&Bear, H&M

Shoppers suspected intentional website glitches, app crashes, or delays on platforms like Fashion Nova, ASOS, Massimo Dutti, Pull&Bear, and H&M, which prevented them from securing discounted products, fueling distrust. - Expired Deals Due to Misleading Timeframes – Zara

Limited-time offers on Zara’s platform often expired before shoppers had a chance to complete their purchase, leaving them feeling duped. - Technical Errors in Validating Orders but Charging Customers Anyway – H&M

H&M users reported technical issues where their orders failed to validate but the platform still charged their accounts, leading to frustration and distrust.

Misleading Pricing and Poor Customer Service

In addition to our findings, we leveraged AI-powered analytics tool Insight Miner to analyze the sentiment and key themes within the reviews. One standout observation is a recurring pattern of misleading pricing tactics and poor customer service:

“Users are unhappy with misleading pricing tactics during sales, where original prices are inflated to make discounts seem larger. Customer service is unresponsive and unhelpful, especially regarding price adjustments and order issues.”

Declining Satisfaction with Product Prices

“Discount and Promotion Issues:” Users express frustration with the apps’ promotional offers, which often do not work as advertised. Many feel misled by discounts that are not applicable at checkout, and some describe the promotional games as a waste of time.

“Pricing and Customer Service Issues:” Users express frustration with deceptive pricing practices, where displayed prices differ from checkout prices, and misleading sales tactics. Many reviews mention issues with customer service, including unresponsive support and unresolved delivery problems. There are also complaints about added games and features that detract from the shopping experience, and concerns about the reliability of promotions and discounts. Overall, users feel deceived by the pricing.

“Pricing and Promotional Issues:” Users are dissatisfied with misleading pricing during promotional periods, where higher prices are advertised as discounts.

Is Black Friday Still Worth It?

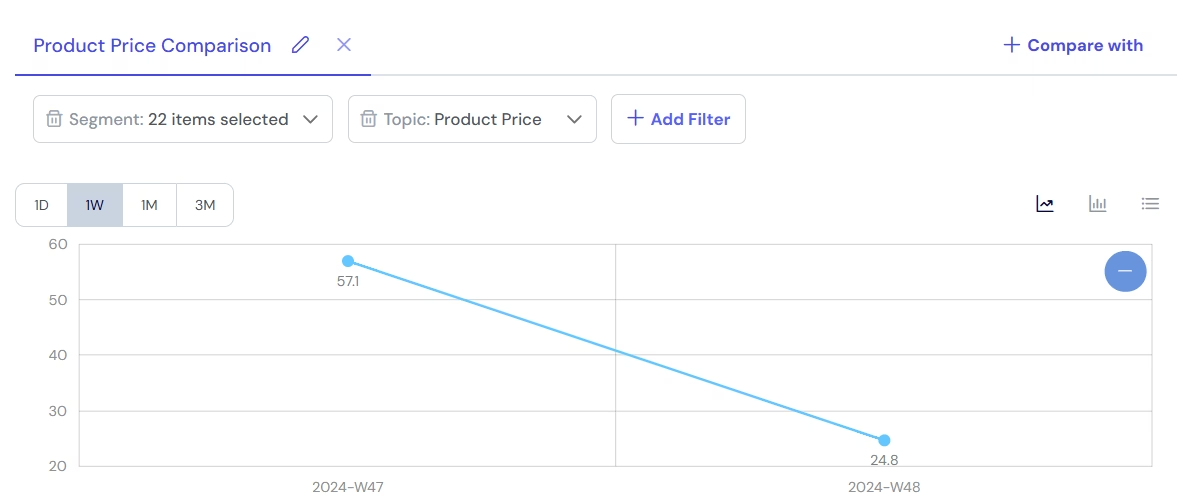

For shoppers, the excitement of Black Friday may no longer be about hunting for incredible bargains but rather sifting through exaggerated claims. The oCX score for “Product Price” dropped significantly from 57 the week before to 25 during Black Friday week, highlighting growing customer dissatisfaction. Customers are clearly disillusioned by pricing strategies that fail to meet their expectations. (week before from to black Friday week)

As the shopping landscape evolves, so too must Black Friday strategies, ensuring that the tradition remains a day of joy rather than disappointment.