In today’s competitive e-commerce landscape, understanding customer feedback has never been more critical. At Alterna CX, we’re proud to offer an advanced Insight Miner tool, powered by advanced AI technology, that transforms raw customer data into meaningful, actionable insights. Whether you’re looking to track sentiment, identify pain points, or spot trends, our Insight Miner can deliver deep, data-driven analyses with impressive accuracy.

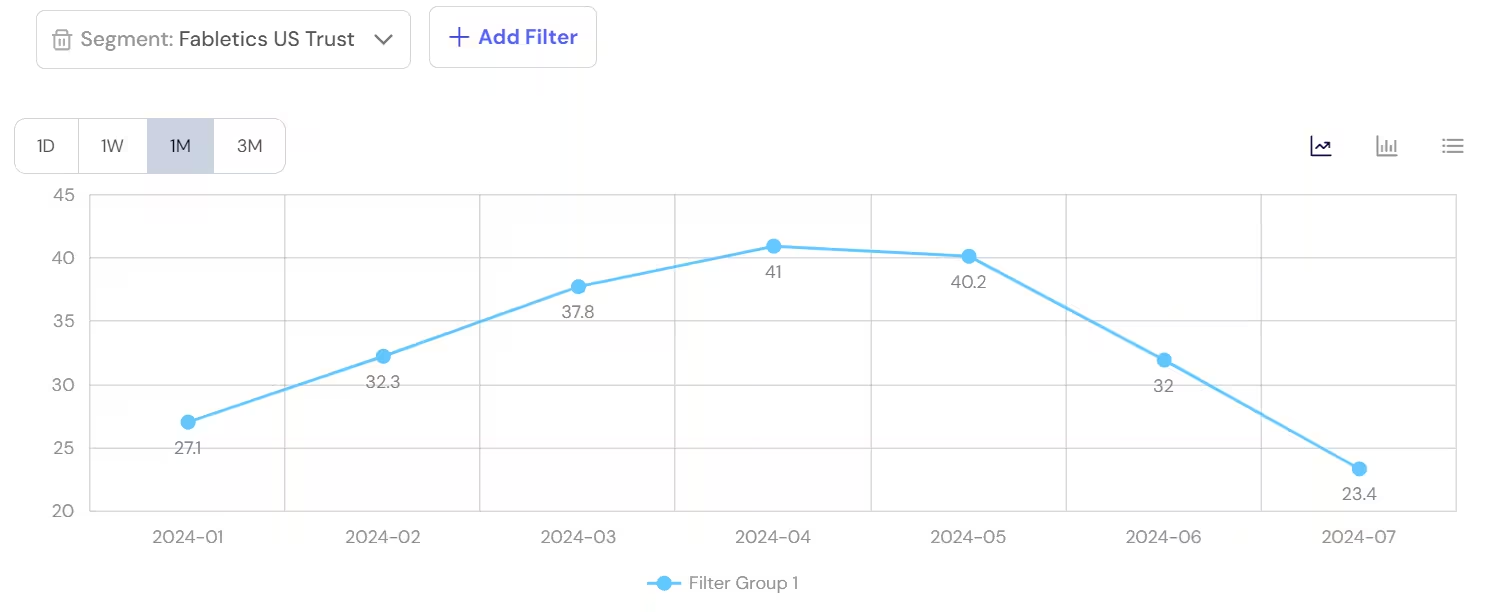

Recently, we put our Insight Miner to the test with Fabletics, a popular activewear brand featured in our latest E-Commerce oCX Report. Using customer data from January to mid-July 2024, we analyzed their Observational Customer Experience (oCX) scores to showcase how customer sentiment evolved over time. Below is a trend analysis of the fluctuations in oCX and what our Insight Miner revealed about the causes behind these changes.

Monthly Trend Breakdown: Fabletics’ oCX Score (January – July 2024)

January 2024 (oCX Score: 27.1)

Why the low score?

Our Insight Miner‘s generative AI discovered that January started with positive reviews for navigation and product quality. However, customers expressed frustration due to stock shortages, confusing membership terms, and website glitches. The tool highlighted unexpected charges as a key pain point, leading to a sharp dip in sentiment.

February 2024 (oCX Score: 32.3)

What improved?

Generated by our Insight Miner’s AI, this insight indicates that while issues with membership confusion persisted, improvements in website navigation and product offerings helped Fabletics bounce back. Positive customer reviews focused on new deals and the VIP program, leading to a moderate increase in the oCX score. Nonetheless, technical glitches and billing challenges remained.

March 2024 (oCX Score: 37.8)

Why did the score climb?

Insight Miner’s generative AI spotted a substantial rise in customer satisfaction in March. Smooth checkout experiences, appealing promotions, and an expanded product range were frequently highlighted. However, minor frustrations with promotional codes and occasional website slowness still affected user experience.

April 2024 (oCX Score: 41.0)

Peak performance!

Generated by Alterna CX’s Insight Miner:

“Customers found the shopping experience seamless, highlighting Fabletics’ wide range of styles and an efficiently run membership program. Positive mentions of customer service and product quality led to Fabletics’ highest oCX score to date. However, technical issues related to the membership system were raised in some negative reviews.”

This is a prime example of the Insight Miner identifying what works best for brands—enabling Fabletics to focus on its strengths while addressing emerging concerns.

May 2024 (oCX Score: 40.2)

Staying steady

Our AI revealed a slight drop from April. This insight suggests that while customers praised product quality, website glitches and membership pricing issues resurfaced as common complaints. By leveraging these findings, brands can spot early signs of frustration, allowing them to take preventative measures before negative sentiment escalates.

June 2024 (oCX Score: 32.0)

Back to challenges

Another AI-generated insight shows that June saw a significant drop due to continued issues with website performance, stock shortages, and confusing membership policies. Product satisfaction remained high, but operational difficulties dragged down the overall score.

July 2024 (oCX Score: 23.4)

Major decline

Generated by Alterna CX’s Insight Miner:

“A sharp decrease in oCX was noted as customers faced challenges with slow website performance, inaccurate inventory displays, and increasing dissatisfaction with membership pricing. While product quality remained consistent, long shipping times and sizing discrepancies contributed to a negative customer experience.”

These AI-generated insights enable businesses to pinpoint areas of concern and take timely action to prevent further dissatisfaction.